Except for the surviving or new domestic cooperative, Minnesota limited liability company, or foreign business entity, the separate existence of each merged or consolidated domestic or foreign business entity that is a party to the plan ceases on the effective date of the merger or consolidation. Unless uncertificated membership interests are prohibited by the articles or bylaws, a resolution approved by the affirmative vote of a majority of the directors present may provide that some or all of any or all classes and series of its membership interests will be uncertificated membership interests. The resolution does not apply to membership interests represented by a certificate until the certificate is surrendered to the cooperative.

.511 REGULAR MEMBERS’ MEETINGS.

The bylaws shall prescribe the allocation of profits and losses between patron membership interests collectively and any other membership interests. If the bylaws do not otherwise provide, the profits and losses between patron membership interests collectively and other membership interests shall be allocated on the basis of the value of contributions to capital made by the patron membership interests collectively and other membership interests and accepted by the cooperative. An action required or permitted to be taken at a meeting of the members may be taken by written action signed, or consented to by authenticated electronic communication, by all of the members. If the articles, bylaws, or a member control agreement so provide, any action may be taken by written action signed, or consented to by authenticated electronic communication, by the members who own voting power equal to the voting power that would be required to take the same action at a meeting of the members at which all members were present. Unless otherwise stated in the articles, bylaws, or a member control agreement, in the case of voting as a class or series, the minimum percentage of the total voting power of membership interests of the class or series that must be present is equal to the minimum percentage of all membership interests entitled to vote required to be present under section 308B.525.

Subd. 6.Penalties for contract interference and false reports.

If the board fails to select a place for a meeting, the meeting must be held at the principal executive office, unless the articles or bylaws provide otherwise. (2) may not be the basis for the imposition of liability on any director, officer, employee, or agent of the cooperative on the grounds that the action was not an authorized cooperative action. (2) may not be the basis for imposition of liability on any director, officer, employee, or agent of the cooperative on the grounds that the action was not authorized cooperative action. A cooperative shall have bylaws governing the cooperative’s business if an expense has been incurred but will be paid later, then: affairs, structure, the qualifications, classification, rights and obligations of members, and the classifications, allocations, and distributions of membership interests, which are not otherwise provided in the articles or by this chapter. (b) The certificate shall be signed by the chair, vice chair, records officer, or financial officer and filed with the records of the cooperative. “Patron membership interest” means the membership interest requiring the holder to conduct patronage business for or with the cooperative, as specified by the cooperative to receive financial rights or distributions.

Subd. 9.Indemnification of other persons.

Here are a few common questions about how accrued expenses work with Salesforce and tax reporting. For more info on creating accrued expenses with Accounting Seed, check out our knowledge base. Bench financial statements can help you find ways to grow your business and cut costs. You now carry $3,000 in accrued expenses on your books to reflect the $3,000 you owe the landlord.

- A director against whom a claim is asserted under this subdivision, except in case of knowing participation in a deliberate fraud, is entitled to contribution on an equitable basis from other directors who are liable under this subdivision.

- However, accrual-basis accounting is considered a more accurate form of business accounting, telling a more complete picture of financial health.

- The regular members’ meeting shall be held at the principal place of business of the cooperative or at another conveniently located place as determined by the bylaws or the board.

- Let’s say Company ABC has a line of credit with a vendor, where Vendor XYZ calculates interest monthly.

- If it is reasonably concluded that the telephonic transmission or authenticated electronic communication is valid, the inspectors of election or, if there are not inspectors, the other persons making that determination shall specify the information upon which they relied to make that determination.

Recording accrued expenses (as opposed to sticking with cash basis accounting) can have a big impact on how you understand your business’s financial position and cash flow. Accrued expenses theoretically make a company’s financial statements more accurate. While the cash method is more simple, accrued expenses strive to include activities that may not have fully been incurred but will still happen. These refer to the recognition of revenues that have been earned but not yet recorded in the company’s financial statements.

Subd. 3.Notice.

If it is reasonably concluded that the telephonic transmission or authenticated electronic communication is valid, the inspectors of election or, if there are not inspectors, the other persons making that determination shall specify the information upon which they relied to make that determination. A proxy so appointed may vote on behalf of the member, or otherwise participate, in a meeting by remote communication under section 308B.531, to the extent the member appointing the proxy would have been entitled to participate by remote communication if the member did not appoint the proxy. (2) telephonic transmission or authenticated electronic communication, whether or not accompanied by written instructions of the member, of an appointment of a proxy with the cooperative or the cooperative’s duly authorized agent at or before the meeting at which the appointment is to be effective.

Or accrued interest owed could be interest on a bond that’s owned, where interest may accrue before being paid. Get a close-up view of how accounting on Salesforce can eliminate the need for costly integrations—and silos of mismatched information—by sharing the same database as your CRM. To learn more about how Accounting Seed can help you manage your business financial life, take a test drive of our platform through the Salesforce AppExchange. We’ll be happy to schedule a demo to show you how our software can help your brand get to the next level.

(a) Unless otherwise provided in the contribution agreement, in the event of default in the payment or performance of an installment or call when due, the cooperative may proceed to collect the amount due in the same manner as a debt due the cooperative. If a would-be contributor does not make a required contribution of property or services, the cooperative shall require the would-be contributor to contribute cash equal to that portion of the value, as stated in the cooperative required records, of the contribution that has not been made. (b) Subject to paragraph (c), a written restriction on the assignment of financial rights that is not manifestly unreasonable under the circumstances and is noted conspicuously in the required records may be enforced against the owner of the restricted financial rights or a successor or transferee of the owner, including a pledgee or a legal representative.

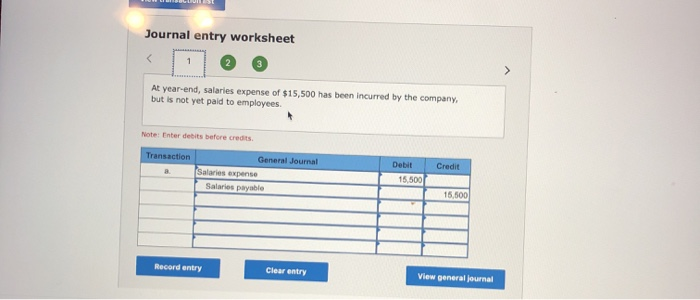

This is accomplished by adjusting journal entries at the end of the accounting period. The company would make a journal entry to record the expenses as an accrual if it has incurred expenses but has not yet paid them. This would involve debiting the “expenses” account on the income statement and crediting the “accounts payable” account.

This would involve debiting the “expense” account and crediting the “accounts payable” account. An accrued liability is an expense that a business has incurred but not yet paid for. These are goods and services already delivered to a company for which the costs must be paid in the future.